EDIT Nov. 6th 2024: Donald Trump wins the 2024 U.S. Elections. Congratulations to the new President of the United States of America.

As we look from Europe at the impending U.S. election, this post examines the potential economic and market impacts of a Trump or Harris victory. While Trump’s policies may spur industrial and export growth, Harris faces the challenge of defining a new economic direction separate from Biden’s. History shows that markets often look beyond political shifts, driven more by unpredictable events than by election outcomes. However, in the short term, each candidate’s unique approach could affect American industries and stock market sentiment, with global implications. Here’s a closer look at the stakes and what Europe might expect from across the Atlantic.

In this article:

- A global perspective on the upcoming U.S. elections

- The fog of polarized politics and the stock market’s independent course

- The Trump years and stock market performance: a reference frame

- Assessing Kamala Harris: an uncharted path

- European sentiment and perceptions on Trump vs. Harris: a distant view on U.S. election dynamics

- European markets and U.S. election outcomes

- Market steadiness and long-term view amid election outcomes

- A wish for humanism and progress

- Consider buying me a coffee without buying me a coffee

A global perspective on the upcoming U.S. elections

As a European observer, I watch the upcoming U.S. election from a certain distance, yet with a keen sense of anticipation. For better or worse, America’s influence transcends borders, affecting economies and political trends across the globe. In today’s interconnected financial landscape, investors, analysts, and thinkers worldwide are attuned to what November 5th will bring — not merely as a national event, but as a global one.

Historically, Alexis de Tocqueville, a keen observer of American society, wrote extensively about the young republic’s unique values and robust institutions. Almost two centuries later, his insights are still resonant, as the U.S. remains a cultural and economic lodestar. Just as ancient Greece shaped philosophy and Renaissance Europe nurtured intellectual brilliance, the United States has forged a path as a modern crucible of political and financial innovation.

As we delve into the likely financial implications of the upcoming election, one question looms: Will the stock market respond favorably, or will it waver? And, more specifically, what do these fluctuations mean for the rest of the world?

The fog of polarized politics and the stock market’s independent course

This election cycle has made it difficult to clearly understand each candidate’s economic policies. A key reason for this is the pervasive spread of disinformation and the intensely polarized tone of the media. Ironically, rather than fostering transparency, the abundance of news sources and platforms has created a more clouded landscape, one where headlines often reflect entrenched positions rather than balanced insight. This trend hinders the ability to form an unbiased judgment and exposes a troubling shift in the way political dialogue is conducted.

In decades past, political disagreements were sharp, yet debates generally held a foundation of dialogue, however fierce. But now, this contrast has intensified to levels that feel antagonistic and, in many ways, inhumane. Both sides are guilty of perpetuating this divide, creating an environment that seems to leave little room for nuanced discussion.

Can this heightened “bad politic” really impact market dynamics? It’s uncertain, yet past patterns suggest that financial markets often chart their own course, sometimes even moving contrary to the expected reaction to political events. Investors, looking beyond the immediate noise, tend to focus on fundamentals and long-term factors.

Many times, we observe the stock market rising or remaining steady against a backdrop of political conflict, almost as if it’s immune to the shifting tides of public opinion. This detachment reflects a market that, paradoxically, may be less affected by political disfunction than by underlying economic stability and global financial trends.

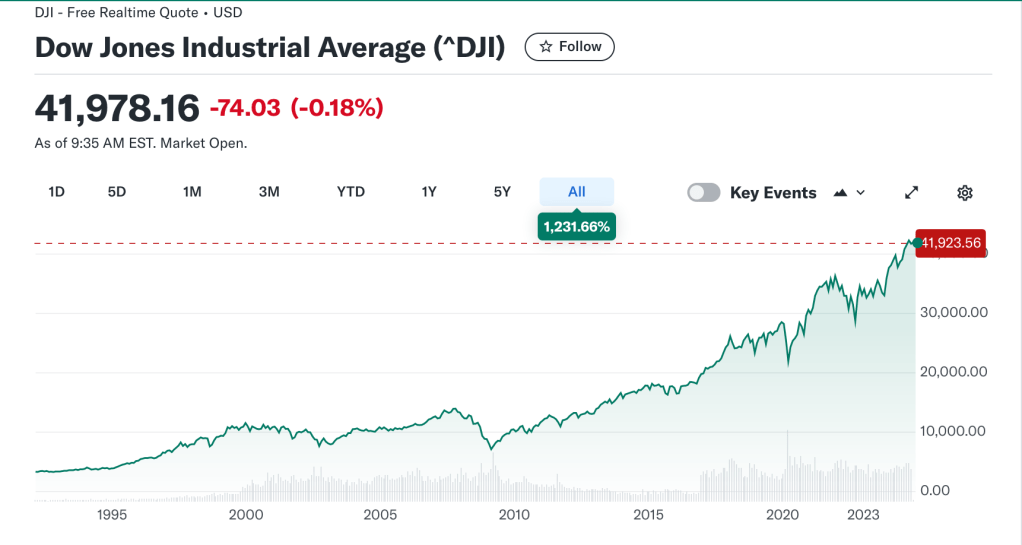

Chart from Yahoo!Finance of many decades of DJIA index:

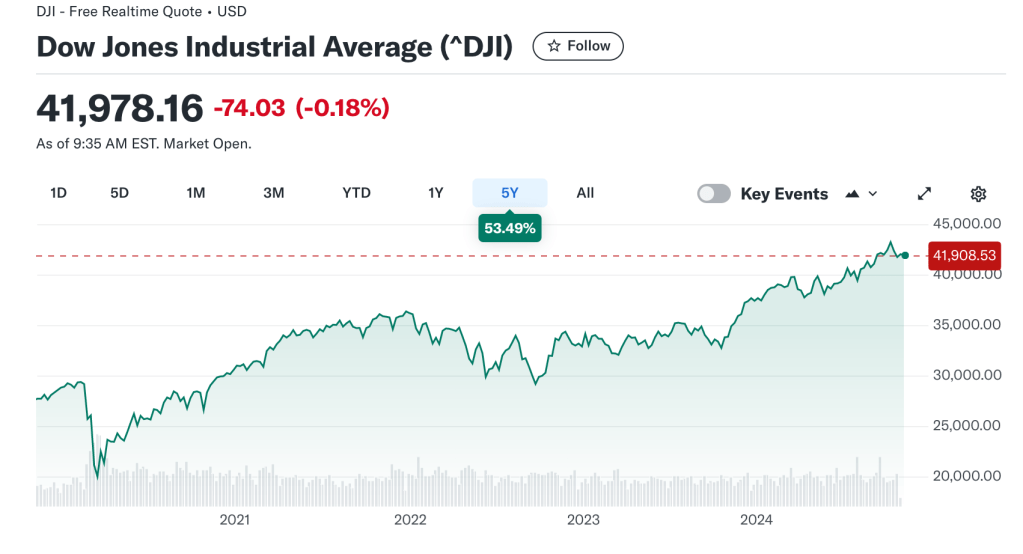

The Trump years and stock market performance: a reference frame

Donald Trump’s presidential term, from January 20, 2017, to January 20, 2021, provides an intriguing frame of reference when analyzing the potential impact of leadership on the stock market. Over these four years, the main U.S. indexes experienced significant fluctuations. Looking at the Dow Jones Industrial Average (DJIA), S&P 500, and Nasdaq on charts (like those available on Yahoo!Finance) reveals a steady climb in the first three years of Trump’s term, followed by a steep drop during the early 2020 COVID-19 pandemic. Despite the initial plunge, the stock market rebounded quickly, ending his term higher than it began.

Trump’s economic policies were notable for their pro-industry focus, favoring American manufacturing and reducing corporate taxes through the 2017 Tax Cuts and Jobs Act. This legislation slashed the corporate tax rate from 35% to 21%, encouraging both U.S. and foreign companies to invest and expand operations in America. Additionally, Trump’s administration imposed tariffs on Chinese imports, aiming to reduce the trade deficit and strengthen U.S. manufacturing — a policy that was polarizing yet aligned with his “America First” platform. These measures were largely seen as beneficial for American industries.

But remember: past stock market trends are not reliable indicators of future performance. The stock market is influenced by a complex blend of factors, and the Trump administration’s economic approach was just one piece of the larger financial puzzle.

Assessing Kamala Harris: an uncharted path

Unlike Donald Trump, Kamala Harris has no prior presidential term to evaluate, which makes forecasting the potential impact of her leadership on the economy and markets challenging. Our closest frame of reference is her current role as Vice President under Joe Biden, but it’s important to distinguish that the economic policies of the Biden administration may not necessarily reflect Harris’s own stance. As Vice President, Harris has been involved in supporting Biden’s initiatives but hasn’t directed the economic agenda, leaving open the question of how closely she might align with his policies if she were to take office.

Under Biden, the administration implemented several key measures, including significant pandemic relief funding, infrastructure investment, and tax proposals aimed at corporations and high-income earners. The American Rescue Plan, for instance, infused over $1.9 trillion into the economy, aiming to stabilize it during the COVID-19 recovery phase. Additionally, the bipartisan infrastructure bill allocated substantial funds for rebuilding and upgrading the nation’s infrastructure, a move that has positively influenced sectors like construction and renewable energy. Despite these initiatives, the market has faced volatility during Biden’s term, partly due to inflation concerns, rate hikes by the Federal Reserve, and global supply chain issues.

Predicting how Harris might approach economic policy remains speculative. She could continue along the same lines as Biden, focusing on investment in infrastructure, climate initiatives, and social welfare. Alternatively, she may pursue a new direction, as she brings her own priorities and perspectives to the table. The stock market’s reaction to a Harris-led administration would ultimately depend on her policy choices, making this a highly uncertain but interesting potential shift.

European sentiment and perceptions on Trump vs. Harris: a distant view on U.S. election dynamics

In Europe, the sentiment around the upcoming U.S. election appears somewhat removed from the intensity of U.S.-based media coverage, giving space to a perception that Trump has a strong chance of winning, particularly given his momentum in independent polling and his favorable odds in betting markets. Bookmakers tend to place Trump as a likely winner, and this is not entirely surprising; he resonates with a sizable base that sees him as a candidate who can return America to a past vision of strength. In contrast, Kamala Harris’s candidacy, while meaningful, may appear underwhelming. The U.S. media has frequently spotlighted Harris, especially on issues related to reproductive rights, climate change, and economic inclusion, but her public image faces challenges due to ongoing doubts about her leadership strength and her preparedness for the presidency, particularly among independent voters and even some Democrats.

This contrast may foster a perception in Europe that the Democratic ticket lacks the dynamism needed for a clear win. Harris’s polling figures reveal that only a minority of voters see her as a strong leader, with concerns lingering from a series of political setbacks early in her vice presidency. While she has since made efforts to reshape her public role, her visibility and influence outside key Democratic circles remain limited, especially in areas like foreign policy, which is critical in today’s global landscape. As Harris aims to consolidate her base and appeal to a broader electorate, some of these efforts, like high-profile media attention, could risk seeming overly managed, which could potentially backfire and deepen doubts around her leadership capabilities.

European markets and U.S. election outcomes

From the European market perspective, a Trump victory would likely renew concerns about protectionist policies. Trump’s past approach, including tariffs on both Chinese and European goods, created trade uncertainties that could potentially return with his re-election. Such tariffs, aimed at bolstering U.S. manufacturing and reducing reliance on imports, risk increasing costs for European exporters and destabilizing trade relations. However, these tariffs might have mixed effects. European consumers and industries could benefit from buying American goods and raw materials, made more affordable by potential Trump measures. This currency advantage could also make U.S. travel more accessible for European tourists, indirectly supporting the U.S. tourism economy.

On the other hand, a Harris administration would likely aim to stabilize and strengthen multilateral trade partnerships, which may relieve some of the tariff pressures seen during Trump’s term. Nevertheless, European markets might feel cautious given that any Democratic economic plan will need to address inflation and the ongoing challenges of “subsidy-heavy” economics, which have limited long-term investment returns under the Biden administration. This is particularly relevant in Europe, where inflation has also spiked and calls for sustainable economic policies are loud. European markets are intertwined with the U.S. economy, and thus, both the Eurozone and the U.S. could benefit from a recovery that emphasizes productive growth rather than reliance on subsidies.

For long-term investors, market performance is often evaluated in decades rather than election cycles, and thus, the broader trend may remain steady regardless of who wins. While European stocks have also experienced positive rallies, stability in U.S.-European trade and economic policies would further boost confidence among investors and long-term traders on both sides of the Atlantic.

Market steadiness and long-term view amid election outcomes

Stock markets, by nature, are often more resilient and pragmatic than one might assume, typically absorbing political shifts with minimal disruption. Instead, it’s the unexpected, disruptive events—such as banking collapses, regional crises, or sudden trade disruptions—that usually trigger sudden downturns or temporary bear markets. Examples like the COVID-19 pandemic, the 2008 financial crisis, or the recent banking failures illustrate how unpredictable incidents, rather than predictable political changes, tend to sway the markets in the short term.

For investors, the most proven strategy is long-term investment, buying stocks with the intention of holding them for a decade or more. This approach not only rides out political shifts but also benefits from gradual economic growth. Whether Trump or Harris wins the presidency, it is improbable that the new leader would fundamentally alter market direction. However, each candidate’s economic policies will influence specific sectors; Trump’s favor among industrial and manufacturing stocks may indeed fuel a rally in American exchanges if he returns to office, with potential gains in industries tied to exports and manufacturing.

Trump’s approach is closely linked to influential entrepreneurs like Elon Musk, with whom he shares a strong rapport during this electoral campaign. Their relationship highlights a mutual commitment to boosting American manufacturing and technological innovation. This alignment could enhance confidence among investors and businesses, potentially invigorating industries tied to production and advanced technology, with significant implications for the stock market.

Conversely, while Harris may not generate the same initial enthusiasm in the market, this doesn’t imply a change in overall market trends. Her economic approach, as a continuation or evolution of Biden’s, will be closely watched, but traders will likely prioritize broader economic indicators over political leadership in the long term.

Ultimately, maintaining a decade-long perspective on market investments provides a steady path through the ebb and flow of politics and economic cycles.

A wish for humanism and progress

Here in Europe, we observe the United States from afar, like voyagers on an old vessel loaded with history, gazing across the ocean with a reflective, almost philosophical distance. We are naturally inclined to contemplate and debate the issues — sometimes fiercely adopting perspectives — while being cushioned by the space that separates us. Yet, we’re not there; we cannot wholly grasp the intricacies of the decisions facing the United States today.

Personally, my hope is for a future of balanced politics in the U.S., where the next President prioritizes not only growth and industrial progress but also the betterment of humanity. A path that values the well-being of people in the U.S. and beyond would be a beacon for the whole world. With this sentiment, I wish all Americans the best as they make their choice in this election.

I’d love to hear your thoughts — whatever side of the Atlantic you’re on! Feel free to share your perspective in the comments below.

Cheers,

Lorenzo.

Consider buying me a coffee without buying me a coffee

I’m glad if you found my post helpful or interesting.

Would you like to manifest your gratitude? I appreciate it a lot, thank you by heart ❤ !

Here’s a way I found that’s a bit unconventional and does not involve the transfer of money from your part to mine. Listen, it’s easy:

Instead of the traditional “buy me a coffee” thing, why don’t you buy yourself a website?

Yes, because I promote a great web hosting company (a hosting is literally where your website has its home online): WordPress.com.

And the better part is that I promote with a discount too! A big 30% discount for you, only through my link!

If you make a purchase through my link, I get a commission. It’s an affiliate marketing mechanism. So, a sort of modern version of a coffee.

Here’s how to get the discount:

go to WordPress.com through this –> link.

When you’ve found the plan that best fits your need, at checkout insert my code (there’s a small box for coupon codes / discounts): WP30XH9K

–> More infos on my dedicated page here.

Nowadays, having a website is almost a necessity. It’s your own space on the Internet where nobody can ban you, it’s your little own reign. Make it what you want: a blog to share your passion, an e-commerce site for your business, or the next Big Thing. A website is a business, and if you are serious about it, it can make you rich.

And creating a website today is straightforward, it doesn’t require coding. You can make beautiful things just by arranging pre-formatted parts of the layout. It’s called block editor, a great feature of the wordpress architecture. I even made a YouTube video showcasing the exceptional features of WordPress.com hosting! Watch it here.

Then, fill your website with your unique content. Be useful to others, like my post has been for you. The secret of success is so simple: be helpful 🙂

So, in promoting WordPress hosting, I’ll get my coffee. You’ll get a 30% discount for your yearly plan, free domain included (the domain is the name of your website). Plus, you’ll get an adventure of a lifetime: your own website to grow.

MoneyPlato.com (this website of mine) is built on WordPress.com, and I keep choosing WordPress.com for other projects and other clients’ projects to build.

If not you, but a friend or acquaintance of yours might be interested in having a website, consider showing him / her my exclusive 30% discount link.

More nerd/tech-specialised people can also look at Pressable hosting for managing multiple sites (it’s made from the same WordPress.com staff). My link and info on Pressable are here, with 15% discount on first month.

Thanks again, and I hope you found this post helpful!

Feel free to share your thoughts in the comments or ask any questions you may have 😉

Leave a comment