There’s a skill that’s not only super useful for anyone getting into stocks, it’s just fundamental: I’m speaking about the ability to read stock charts.

Overall it’s not something out of the reach of anyone. But there are some subtle things to watch out for when you’re looking at price trends, and that’s what we’re going to unpack today. I’m going to walk you through three key things to be aware of when reading stock charts.

All of them are useful, but stick around because the third one might just be the most significant. Let’s jump in!

- 1 – Use Line Charts

- 2 – Consider the Time frame

- 3 – Understand price trend

- Conclusion

- Consider buying me a coffee without buying me a coffee

1 – Use Line Charts

First, you have to keep things simple when you’re starting out. Now, the internet — and a lot of so-called experts — will tell you that you absolutely need the chart in the form of candlesticks, But I disagree.

Yes, candlesticks maybe can tell more about the daily path of price, because they offer a visual representation of the price movement in a day.

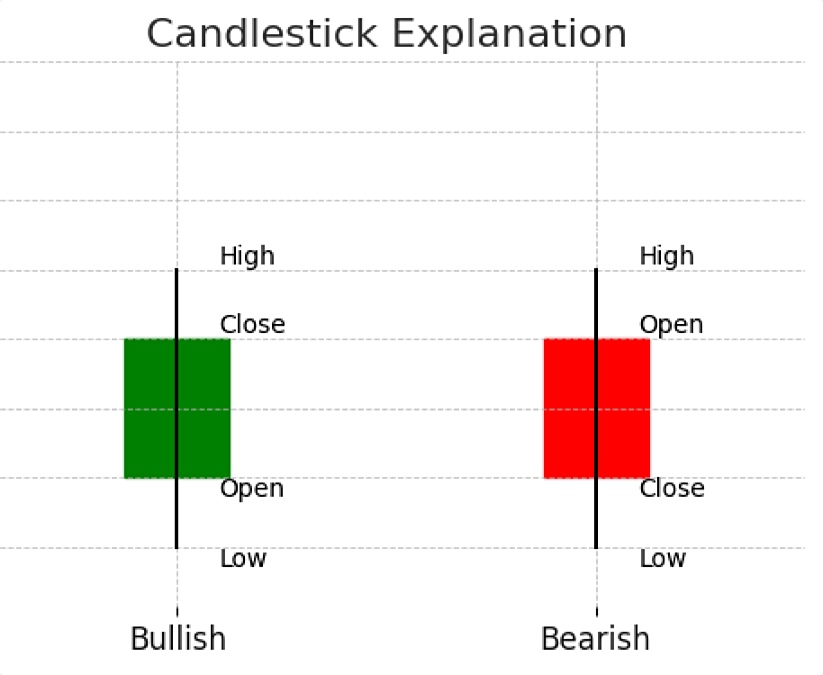

Let me explain briefly what is a candlestick: let’s consider a daily price chart of a company; for each day, a candlestick shows the price at open, the price at close, and the lowest and highest price for that day. The candle is green if the price has closed positive that day, and the candle is red if the day has closed with a negative price.

Traders who do day trading use a lot the candlestick charts. And you don’t want to do day trading!

Day trading is like chaining yourself to your screen, stressing over every little swing. I’m not about that life, and you shouldn’t be either. I see investing in stocks as a form of a medium to long-term way of investing. There’s no point in doing day trading, as it’s a kind of slavery for a trader.

So, use line charts. It’s simpler, it gives the overall price trend, it shows daily the price at close, giving you the overall trend, and it’s better. It’s all you need, really.

There are plenty of free online tools to see price charts. Even searching fo a company on Google gives the price of its stock, in the form of a simplified line chart. You can use also Yahoo Finance, and a lot of other free finance website.

2 – Consider the Time frame

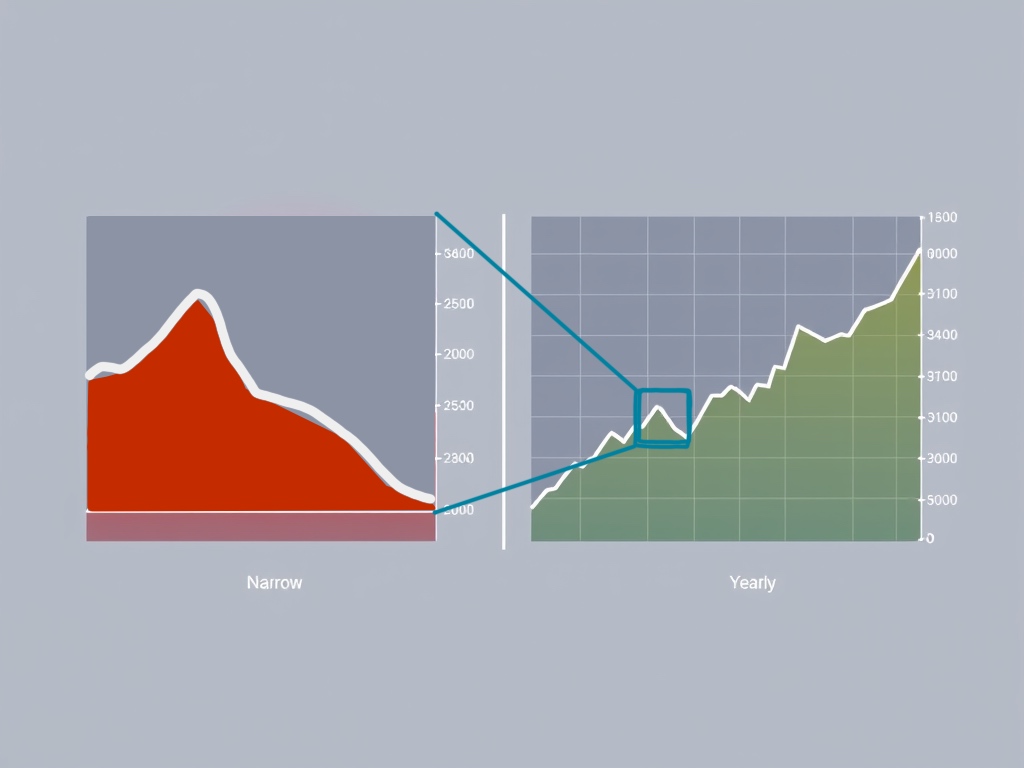

The second thing I want you to be aware of is time frame. It’s easy to look at a chart in a narrow time frame and judging from there. However, look at a simple example just to give you an idea.

What looks one way up close can feel totally different when you zoom out. For example, a stock might dip hard over three days, and it looks scary — like it’s crashing. But pull back to a few months, and that dip now looks just like a tiny blip.

Try always to move from local to wide time frame, from days to months and years, and also look at the overall lifetime trend of a company price. This is not because previous trend should dictate what happens next, but just to give you more elements to decide!

I’m not saying past trends predict the future, but starting local with days, then stepping back to months, years, and the lifetime trend gives you more pieces to the puzzle. With a line chart, this is a breeze — just adjust the scale and see the bigger picture. It’s all about context.

3 – Understand price trend

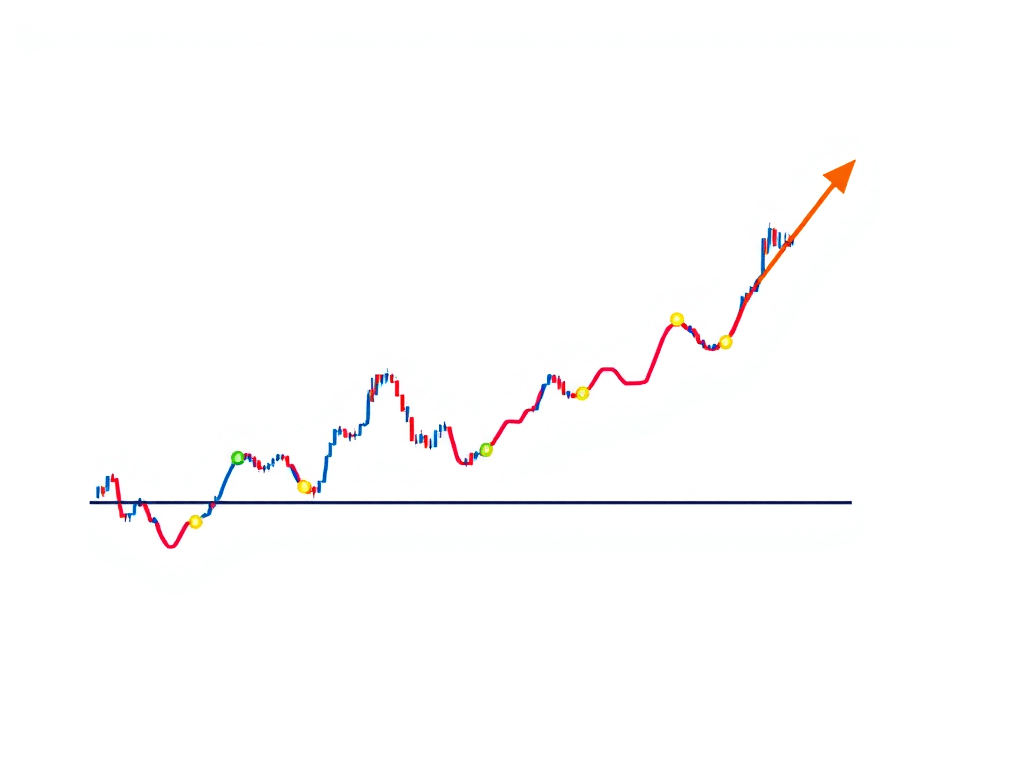

Now, the third thing — and this might be the most significant — is understanding what really are price trends. At first glance, it seems simple: is the line going up, down, or sideways?

This might appear simple, but having a grasp on price trend is probably the most relevant skill for a trader, and it really takes years to master. Yes, because the most important thing to remember is that all of those techniques and such of reading charts, the so-called technical analysis, have some relevance, but do not tell the whole story.

In particular, price trend gives you just some possible direction, but the most important thing to remember is that previous trend does not predict what will be next, does not predict the next direction in price. So just trade with this in mind.

At its core, a stock chart is just a visual story of how a stock’s price has changed over time. You’ve got the x-axis — that’s time — and the y-axis, which is the price. When you look at a chart, the first thing to notice is the direction. Is the price trending up, down, or sideways? An upward trend — where the price is making higher highs and higher lows — tells you buyers are in control. A downward trend, with lower highs and lower lows, means sellers are winning. And if it’s flat? Well, that’s consolidation — the stock’s just chilling, waiting probably for its next move.

All these chart-reading tricks — technical analysis — matter, but again they’re not the whole story. A price trend, like a steady climb or a sharp drop, gives you a possible direction, and that’s useful. But past trends don’t predict what’s next. Just because a stock’s been soaring doesn’t mean it’ll keep going — or that a dip means doom. So, when you trade, keep this in mind: the trend is a clue, not a crystal ball.

There are simply too many variables that dictate where a price could go. Think about it: economic news, company earnings, market mood, interest rates, even random tweets from big players — those can all flip a trend overnight. The trend is a clue, not a crystal ball. When you trade, keep this in mind: it’s one signal in a noisy world of factors. Use it to guide you, but don’t bet everything on it.

Traders with a bit of experience know that, and they don’t focus much on the occasional dip or spike, but instead they look at the trend on the long term. In fact, usually if a company or an independent is solid, staying in the position for a steady amount of time usually is a good strategy to average the occasional dips and overall maintaining a good positive margin.

Conclusion

I hope you enjoyed those three essentials things to start reading stock charts.

Let me again summarize them: stick to line charts, watch your time frame, and understand price trends (the hardest part of trading!).

It’s about keeping it simple and staying sharp. If this helped, let me know in the comments, and if you liked this post share it with a friend.

Also, subscribe to MoneyPlato for more money tips.

See you!

***

The content of this blog is intended for educational purposes only, and does not constitute financial advice.

Consider buying me a coffee without buying me a coffee

I’m glad if you found my post helpful or interesting.

Would you like to manifest your gratitude? I appreciate it a lot, thank you by heart ❤ !

Here’s a way I found that’s a bit unconventional and does not involve the transfer of money from your part to mine. Listen, it’s easy:

Instead of the traditional “buy me a coffee” thing, why don’t you buy yourself a website?

Yes, because I promote a great web hosting company (a hosting is literally where your website has its home online): WordPress.com.

If you make a purchase through my link, I get a commission. It’s an affiliate marketing mechanism. So, a sort of modern version of a coffee.

Here’s how to get WordPress.com:

–> More infos on my dedicated page here.

Nowadays, having a website is almost a necessity. It’s your own space on the Internet where nobody can ban you, it’s your little own reign. Make it what you want: a blog to share your passion, an e-commerce site for your business, or the next Big Thing. A website is a business, and if you are serious about it, it can make you rich.

And creating a website today is straightforward, it doesn’t require coding. You can make beautiful things just by arranging pre-formatted parts of the layout. It’s called block editor, a great feature of the wordpress architecture. I even made a YouTube video showcasing the exceptional features of WordPress.com hosting! Watch it here.

Then, fill your website with your unique content. Be useful to others, like my post has been for you. The secret of success is so simple: be helpful 🙂

MoneyPlato.com (this website of mine) is built on WordPress.com, and I keep choosing WordPress.com for other projects and other clients’ projects to build.

Thanks again, and I hope you found this post helpful!

Feel free to share your thoughts in the comments or ask any questions you may have 😉

Leave a comment